New Study Reveals Attitude & Behavioral Changes as Wealth Grows

Reaching a certain socioeconomic status may not bring the same freedom and comfort to Americans as it once did. In fact, a new study reveals that today’s affluent are more likely to adopt a defensive mindset of protecting what they have versus spending the wealth they have achieved.

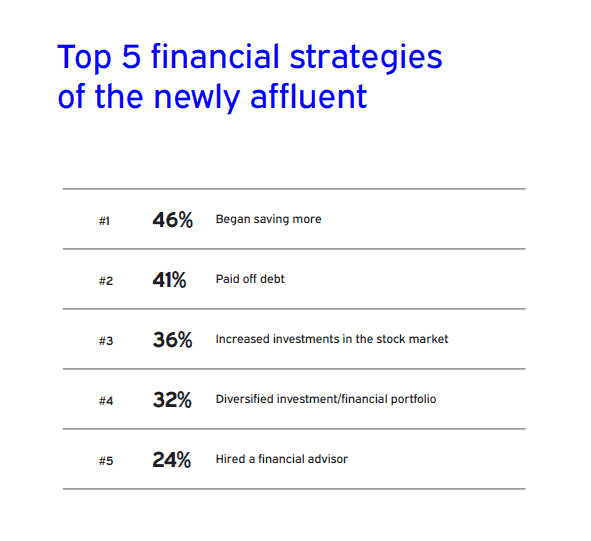

The survey, conducted by Cronin, found that 92 percent of the U.S. affluent report making a change to their financial decision making upon reaching affluence with the intention of protecting the money they have and growing their bank accounts further. And they’re doing it on their own with 58 percent saying that they rely on themselves to manage their money and only a quarter saying they hired a financial advisor.

“Today’s affluent aren’t frivolous spenders; these are individuals who have worked hard for their money and once they reach the affluence threshold they’re more committed than ever to hunker down and protect what they have for themselves and their children,” says Elizabeth Proctor, Vice President, Financial Services Leader at Cronin. “The affluent don’t consider themselves wealthy and are more apt to describe themselves as upper middle class. Whether that’s due to cultural values, economic realities or both is debatable but they’re very concerned about not having enough (money).”

Becoming Affluent

According to the survey, reaching affluence has been a slow and deliberate journey for most. They credit three life practices of responsible money management with helping them cross the affluence threshold: saving money every year (59%), gradually increasing their salary over time (54%) and consistently spending less than they made (45%).

For those who have been affluent for less than five years, the path has been slightly different. This group is significantly more likely to have reached affluence through promotions into high-salary executive positions and by investing in cryptocurrency. This group is also more likely to be concerned they’ve saved too little. Exactly half are reviewing their investment portfolio once a week or more which is slightly more than those who have been affluent for 6-14 years (47%) and 15 years or more (42%).

“The emergence of new investment options that didn’t even exist a decade ago is allowing Americans to increase their wealth faster than before. In fact, according to the U.S. Census Bureau, the percentage of $200,000 plus households has doubled in the past decade. Despite how they got there, the affluent are all much more focused on their money and assets than ever before,” said Proctor.

As the defensive mindset takes hold, more attention is placed on money. Nearly half (48%) of all affluent say attention to their money and assets increased. A similar percentage (47%) say attention to their physical assets increased as well. The attention given to money is strong in the early stages of affluence. For those who have been affluent for less than five years, exactly half are reviewing their investment portfolio once a week or more. As time passes, that percentage declines but not by much.

Threats to Affluence

Uncertainty about the future due to political division in the U.S. and world events are causing the affluent to be concerned about their financial well being. In addition, 58 percent are concerned about the security of their assets and 66 percent are concerned about the security of their personal information online. Data breaches (49%) and storing card information (46%) topped the list of what the affluent are most concerned about regarding digital privacy.

Maintaining the Status Quo

Despite their desire to protect what they have, few have taken action when it comes to their financial providers and services. Only 16 percent have increased their insurance coverage despite the fact that their current coverage may be unsuited for their new income and asset level. Similarly, only 15 percent say that being affluent caused them to reevaluate the financial institutions they work with and only 13 percent are rethinking existing advisor relationships.

Trust is a factor in the lack of action. While the affluent “moderately trust” financial advisors and insurance provides (44% and 42% respectively), they do not give either group a ringing endorsement. Their trust in banks is even lower at 37 percent.

“Despite changes to their socioeconomic status, this group is inclined to maintain the status quo when it comes to their financial services,” said Proctor. “They’re not rushing to reevaluate and change their plans but will take a more thoughtful approach to transitioning to services that are appropriate for their new income and asset levels. They will maintain control over handing the reins to a financial services professional.”

About the Study

The “Wealth of Opportunity” affluent market study was conducted as a nationally representative online survey of U.S. households with income of $200,000 or higher. To view the complete report visit: https://cronin2021.croninqa1.com/research.

Cronin is a leading independent marketing agency. The agency’s capabilities include: branding; consumer insights; omni-channel communications; media planning, buying & management; customer experience; consumer research; content strategy & creation; marketing analytics; creative concepting & design; digital & traditional advertising; digital experience & design; video, animation & photography; performance marketing; marketing automation & CRM; web & mobile development; SEO; public relations; and social media. Cronin is a member of AMIN Worldwide, the American Association of Advertising Agencies, Public Relations Society of America, and is a Premier Google Partner. Follow us on Facebook, Twitter, Instagram, and LinkedIn.